TL ; DR 📖

Macro

• Rates ended the week higher after midweek relief

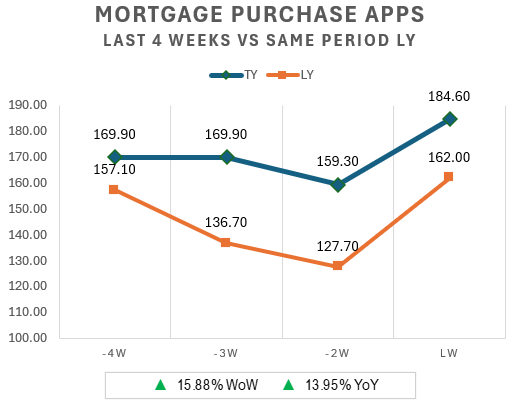

• Purchase apps ⬆️ 16% WoW

• Fed speakers reinforced pause and patience

Central Ohio

• Inventory growth continues to favor buyers, even with a small WoW pullback

• Sales volume is holding, which supports pricing stability

• Price growth is slowing as competition increases

Spotlight: Fed Speakers and Political Pressure 🔦

Federal Reserve officials spent last week reinforcing patience on rates while navigating growing political pressure. Speakers consistently described policy as well-positioned and closer to neutral. Inflation is expected to cool slowly, not collapse. Officials acknowledged progress, but stressed risks from sticky services and tariffs. At the same time, public tension escalated between the Fed and the administration. Markets paid close attention, not for ideology, but for credibility and independence.

Takeaway: Do not expect fast rate cuts. Planning should assume patience and volatility, not a straight path lower.

Spotlight: December CPI Release 🔦

The December CPI report showed inflation holding steady, not accelerating, and not cooling fast enough to change the rate outlook. Headline inflation matched November on a year-over-year basis, while monthly prices rose at a pace that kept pressure on bonds. Shelter and food remained the primary drivers, reinforcing the stickiness of core inflation. Energy offered some relief, but not enough to offset housing-related costs.

Highlights

• Overall CPI ⬆️ 2.7% YoY, unchanged from November

• Overall CPI ⬆️ 0.3% m/m, seasonally adjusted

• Core CPI ⬆️ 2.6% YoY, excluding food and energy

Takeaway: December CPI kept inflation concerns front and center, reinforcing that mortgage rates and housing demand will stay volatile and highly sensitive to each inflation release.

Spotlight: Federal Reserve Beige Book 🔦

First off, what is the Beige Book? The Beige Book is a qualitative report published eight times per year that summarizes economic conditions across the Federal Reserve’s 12 districts using input from businesses, banks, and community contacts. The latest release showed economic activity improving slightly after several flat reports. Growth remained uneven, with higher-income consumers spending more and lower-income households pulling back. Residential real estate softened across most districts. Lending conditions stabilized, but affordability and price sensitivity increased. The report reinforced a slow-growth environment, not a recession, and not a reacceleration.

Takeaway: The Beige Book supports a steady but constrained housing outlook.

Macro Update 📊

The macro backdrop remains mixed. Inflation cooled, but not enough to unlock sustained rate relief. Markets remain sensitive to every data release. Housing demand proved it can rebound quickly when rates dip, but volatility keeps confidence fragile.

30-Yr Mortgage Rates (Mortgage News Daily)

Mortgage Applications

Federal Reserve (CME FedWatch)

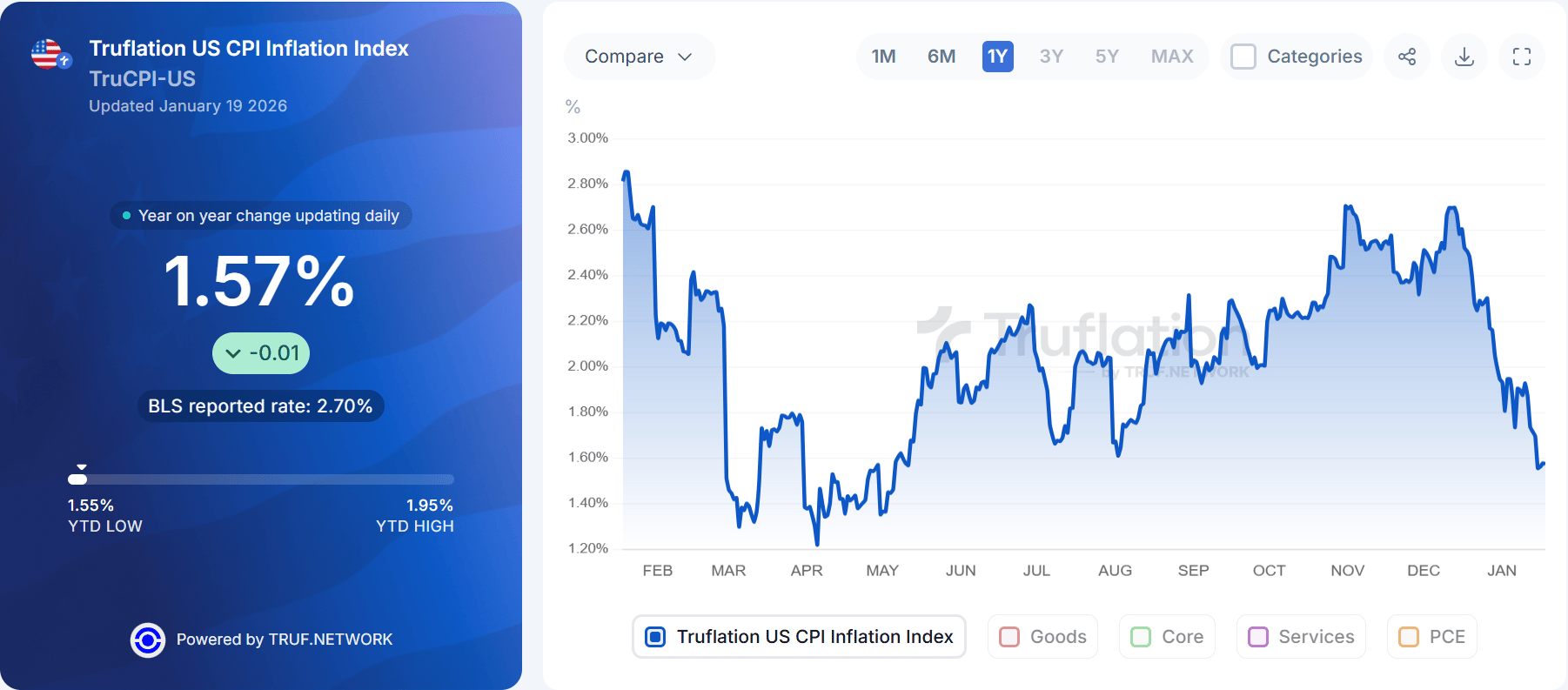

Truflation Index

The Truflation CPI Index uses real-time consumer spending data to track inflation daily. It updates faster than traditional inflation measures to better reflect price changes in today’s economy.

Central Ohio Market Update 🌎📍

Market Dynamics: A Seller’s Market shifting toward Buyer-friendly conditions.

Central Ohio continues to normalize. Inventory remains higher than last year, but it tightened slightly week over week. Sales volume is steady, not surging. Pricing holds, but gains have slowed. Buyers have more leverage through choice and price reductions. Sellers must compete on price, condition, and marketing.

Current Inventory

• Current active inventory 3,815 homes ⬆️ 37.3% YoY ⬇️ 3.2% WoW

Stats from the Last 4 Weeks (12/22 - 01/18)

• Closings 1,365 ⬆️ 1.0% YoY

• New listings 1,482 ⬆️ 14.4% YoY

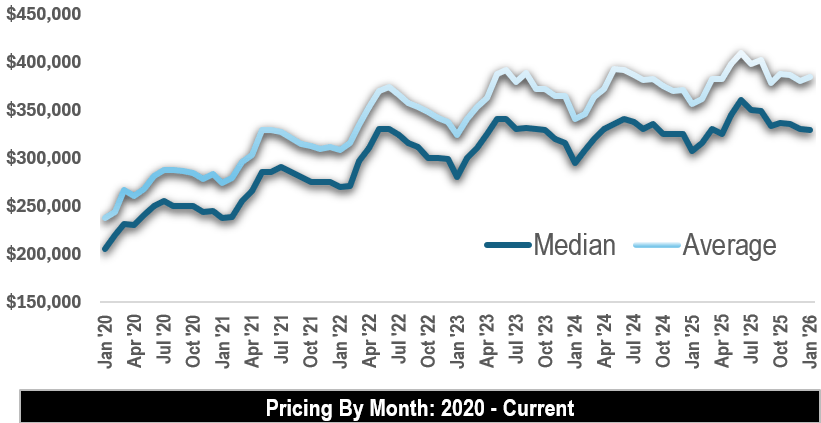

• Median sales price $326,900 ⬆️ 2.2% YoY

• Active listings with price reduction 57.6%

• Avg DOM 45 ⬆️ 18.4% YoY

• Months of supply 2.9

Year to Date (YTD) Snapshot

• YTD closings 734 ⬇️ 8.9% YoY

• YTD median sales price $328,500 ⬆️ 7.7% YoY

• YTD avg $/SF $208.37 ⬆️ 5.6% YoY

• YTD LP/SP 97.7% ⬆️ 0.5% YoY

• YTD new listings 1,309 ⬆️ 22.9% YoY

• YTD avg $/SF $205.51 ⬆️ 1.5% YoY

• YTD LP/SP 97.4% ⬆️ 0.1% YoY

Showings & Affordability

An affordability index of 100 means the median household can afford the mortgage on a median-priced home. Above 100 indicates greater affordability, below 100 indicates reduced affordability.

Local Events 🌎📍

Sources:

· 30-Year Fixed Rate Mortgage Average in the United States (MORTGAGE30US) - Federal Reserve Economic Data (FRED) - https://fred.stlouisfed.org/series/MORTGAGE30US

· 30-Year Fixed Mortgage Rates - Mortgage News Daily - https://www.mortgagenewsdaily.com/mortgage-rates/30-year-fixed

· Mortgage Applications, Purchase Index - Mortgage Bankers Association via Trading Economics - https://tradingeconomics.com/united-states/mba-purchase-index

· CME FedWatch Tool - CME Group - https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

· U.S. Inflation Rate - Truflation - https://truflation.com/marketplace/us-inflation-rate

Disclaimer: The information shared in this newsletter is for educational and informational purposes only and should not be considered legal, financial, or investment advice. Always consult with a qualified attorney, financial advisor, or other professional regarding your specific situation.

—

All data pulled from Columbus REALTORS® Multiple Listing Service (MLS). Central OH is defined as Single-Family, Residential listings from the following Counties - Franklin, Delaware, Licking, Fairfield, Union, Pickaway, Madison, Morrow, Fayette, Athens, Champaign, Clark, Clinton, Hocking, Knox, Logan, Marion, Muskingum, Perry, Ross. Sales figures do not account for seller concessions/credits provided to buyers. Price reductions are defined as a reduction taken at any time during the lifespan of the listing.