Spotlight: Q4 Historical Performance in Central Ohio 🔦

Q4 consistently ranks as the third-strongest quarter for closed sales in Central Ohio, accounting for 24.1% of annual closings. However, Q4 is also the weakest period for contracts (just 20.7% of yearly under contracts), meaning much of what closes in Q4 was actually inked in Q3. This sets up Q1 as the slowest quarter of the year for closings, since fewer homes go under contract in Q4 to carry over into January and February.

For buyers, this creates opportunities. Competition tends to cool off, especially in late Q4, allowing more leverage in negotiations and potentially better terms. Sellers who are already under contract benefit from strong closings, but those listing later in the year may face longer DOM and more price pressure. Investors can find bargains during this slowdown, but should remember that Q1 comps may appear softer due to the thin contract volume late in Q4. Agents should view Q4 as pipeline-building season, knowing that a lighter Q1 is almost guaranteed.

A critical seasonal factor is the sharp drop in buyer activity around the holidays. Historically, showings fall by more than 32% when comparing October through Thanksgiving to the weeks after Thanksgiving to year-end. That means activity gets cut by a third as buyers pause for the holidays. Sellers who list after Thanksgiving must price sharply and expect fewer showings, while buyers and investors who stay active during this period may find motivated sellers more willing to negotiate.

For Buyers: Slower showing activity after Thanksgiving could mean less competition.

For Sellers: Best positioned if already in contract by Q3; late-Q4 sellers may face longer DOM.

For Investors: Seasonal slowdown offers leverage in negotiation on the buy-side.

For Agents: Use Q4 to build your pipeline for Q1, knowing transaction volume will dip.

Central OH MLS Data - 2019-2024

Central OH MLS

Spotlight: What We’re Watching in the Bond Market This Week 🔦

The 10-year Treasury yield could be heavily influenced this week by economic labor data and the looming risk of a government shutdown. For real estate, this matters because bond yields drive mortgage rates (stronger data sends rates higher, weaker data brings them down).

Key Factors Impacting Yields:

Nonfarm Payrolls (Friday): The most important release of the week. The forecast is ~51K jobs added. A weak report could drive yields and mortgage rates lower.

ADP Private Payrolls (Wednesday): Often a preview of Friday’s jobs report. A soft number would add to expectations for Fed cuts.

Job Openings & Jobless Claims (Tuesday & Thursday): Softer labor signals would reinforce the case for lower yields.

Fed Speeches: Multiple officials are scheduled to speak this week. Any dovish comments could push yields down.

Government Shutdown Risk: If Congress fails to reach a budget deal, uncertainty may drive investors into Treasuries, pushing yields lower.

Why We’re Watching Closely:

When employment data weakens, investors expect the Fed to cut rates. That drives demand for Treasuries, which pushes bond prices up and yields down, bringing mortgage rates lower since they closely track the 10-year yield.

The RealTea 🫖

Nationally, mortgage rates ticked up slightly after weeks of easing, while the stock market held positive momentum on AI and steady inflation data. Buyers remain cautious, but mortgage applications rose again, showing resilient demand.

Tailwinds:

Stock indices posted weekly gains, led by AI optimism

Mortgage applications increased despite rates edging higher

Headwinds:

National affordability crisis persists, keeping many buyers sidelined

10-year Treasury yields ended the week at highs, pressuring mortgage rates

Macro Update 📊

Stock Market Performance Last Week

Nasdaq +0.7%

Dow +0.65%

S&P 500 +0.59%

Momentum was driven by AI optimism (Nvidia investing in OpenAI).

10-Yr Treasury Bond Performance Last Week

Sep 22 → Sep 23 → Sep 24 → Sep 25 → Sep 26

4.145% → 4.12% → 4.16% → 4.18% → 4.20%

Weekly high: 4.20% | Weekly low: 4.12%

30-Yr Mortgage Rates (Mortgage News Daily)

Sep 22 → Sep 23 → Sep 24 → Sep 25 → Sep 26

6.35% → 6.37% → 6.37% → 6.39% → 6.38%

Weekly Avg: 6.37%

Today’s rates hover around 6.38%

Mortgage Applications

Mortgage Purchase Applications (Last 4 Weeks):

158.7 → 169.1 → 174.0 → 174.5

Same Period 2024:

141.9 → 143.7 → 147.0 → 144.8

⬆️ 0.3% WoW

⬆️ 17.7% YoY

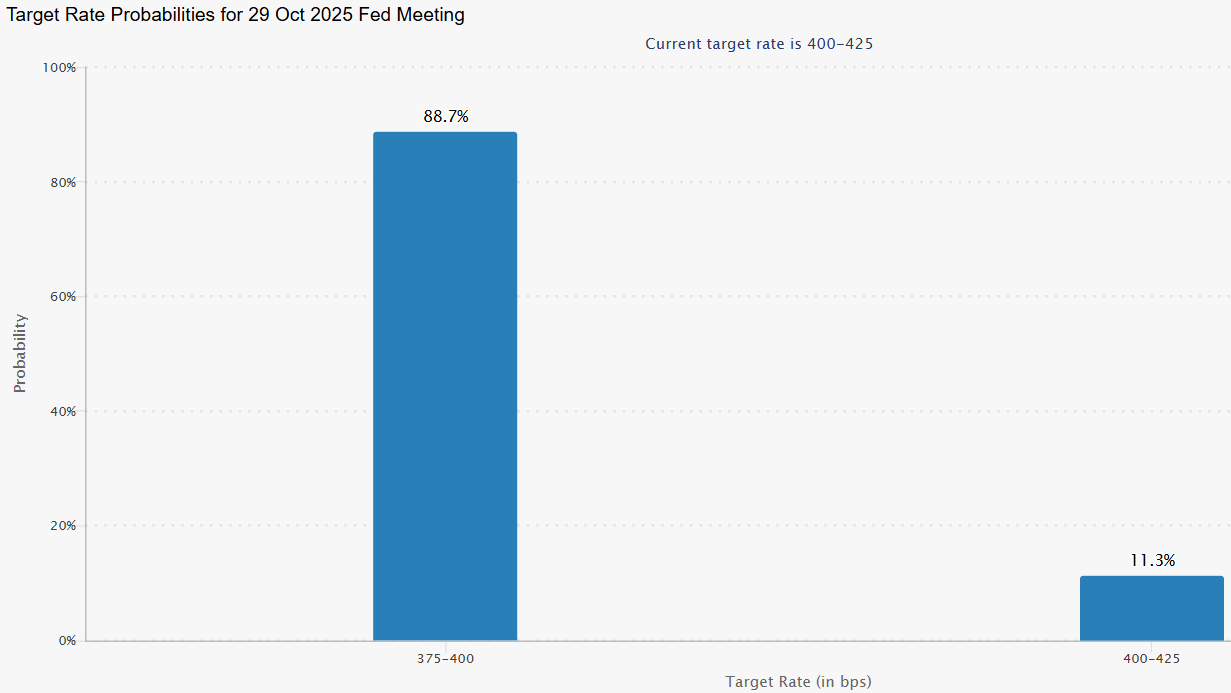

Federal Reserve (CME FedWatch)

Next FOMC – Oct 29, 2025

Chance of no cut: 11.3%

Chance of 25 bps cut: 88.7%

Current Target: 4.0–4.25%

Other Indicators

Fear & Greed Index: 53 (Neutral)

Truflation US Inflation Index: 2.01%

Sentiment on X (Last 7 Days) 📢

National: Buyers remain deeply discouraged as affordability sits at crisis levels. Lower rates near 6.3% gave slight hope for refinancing, but not enough to shift sales. “Stuck market” sentiment dominates.

Columbus: Posts lean neutral-to-positive, with institutional investors still active. Sellers benefit from pricing power, while buyers gain leverage through more inventory and longer DOM.

Pull Quote: “Affordability is getting crushed—rising prices and spiking rates sidelining buyers.”

Central Ohio Market Update 🌎📍

Market Dynamics: A Seller’s Market shifting toward Buyer-friendly conditions.

Central Ohio continues to see a more balanced but slower market. Inventory and new listings remain elevated compared to last year, giving buyers more choice, while affordability has improved modestly in recent weeks. Price reductions are widespread, and days on market are trending higher. Year to date, sales are only slightly below 2024, while prices and $/SF are still holding positive gains, reflecting overall stability despite affordability headwinds.

Stats from the Last 4 Weeks (Aug 31 – Sep 27)

Closings: 2,102 ⬇️ 5.7% YoY

New Listings: 2,826 ⬆️ 16.7% YoY

Active Inventory: 5,432 ⬆️ 68.3% YoY ⬇️ 1.8% WoW

Median Price: $330,000 ⬇️ 1.5% YoY

DOM: 28 ⬆️ 16.7% YoY

Months of Supply: 2.6

% of Actives Reduced: 60%

YTD Snapshot

Closings: 21,034 ⬇️ 0.9% YoY

New Listings: 25,971 ⬆️ 12.7% YoY

Median Sales Price: $338,500 ⬆️ 3.4% YoY

Average $/SF: $213.17 ⬆️ 2.8% YoY

% LP/SP: 98.3% ⬇️ 0.3% YoY

Avg DOM: 30 ⬆️ 12.7% YoY

Months of Supply: 2.6 ⬆️ 82.8% YoY

Showings & Affordability

Question: Where would rates need to be for Franklin County to have an Affordability Index of 100? 🤔

Answer: Assuming a median home price of $340,000 & a median income of $71,680, mortgage rates would need to be at 5.20% to achieve an Affordability Index of 100 - ie, a family with the median income can afford the mortgage payment on a median-priced home. The average weekly Affordability Index for 2025 in Franklin Co. is 91.2. As of June 2025, the National Affordability Index is 94.4 (Source: National Association of Realtors via FRED®).

Franklin County Affordability Index, Last 4 Weeks:

91.0 → 100.7 → 93.2 → 97.2

Same Period 2024:

97.3 → 94.2 → 95.3 → 97.2

WoW: ⬆️ 4.3%

YoY: 0.0%

Showings per Listing (last 4 weeks):

3.9 → 3.9 → 4.1 → 3.8

Same Period 2024:

6.2 → 6.4 → 6.3 → 6.2

WoW: ⬇️ 7.3%

YoY: ⬇️ 38.7%

Raw Showings Last 4 Weeks:

21,815 → 21,710 → 22,593 → 20,679

Same Period 2024:

19,535 → 20,536 → 20,209 → 19,908

WoW: ⬇️ 8.5%

YoY: ⬆️ 3.9%

Real Estate Rendezvous: Oct 22, 2-4 PM 📢

🚀 The next Real Estate Rendezvous is all about your 2026 blueprint for success.

Topics Include:

📊 Market forecast

🤖 Implementing AI in your business

📝 Business planning strategies

Don’t miss this session designed to set you up for an amazing 2026!

Register Here: http://bit.ly/46vDqId

Here’s the data:

All data pulled from Columbus REALTORS® Multiple Listing Service (MLS). Central OH is defined as Single-Family, Residential listings from the following Counties - Franklin, Delaware, Licking, Fairfield, Union, Pickaway, Madison, Morrow, Fayette, Athens, Champaign, Clark, Clinton, Hocking, Knox, Logan, Marion, Muskingum, Perry, Ross. Sales figures do not account for seller concessions/credits provided to buyers. Price reductions are defined as a reduction taken at any time during the lifespan of the listing.