TL ; DR 📖

Macro

• Mortgage rates fell from 6.16% to 6.04%

• Headline CPI ⬆️ 2.4% YoY

• Existing Home Sales ⬇️ 8.4% MoM

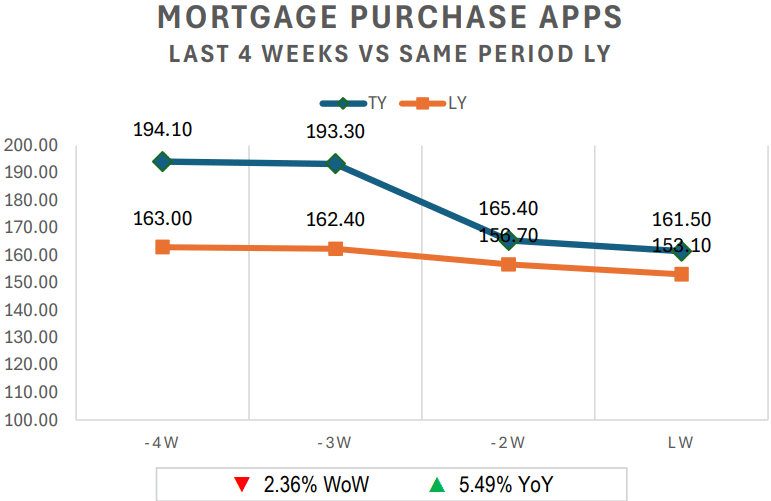

• Purchase apps ⬇️ 2.4% WoW and ⬆️ 5.5% YoY

Central OH

• Active inventory 3,864 to 3,459 over 6 weeks ⬇️ 10.5%

• Active inventory ⬇️ 4.0% WoW and ⬆️ 32.2% YoY

• Showings per listing ⬆️ 11.9% WoW

• Raw showings ⬆️ 7.4% WoW and ⬆️ 5.2% YoY

• Median price $325,000 ⬆️ 3.2% YoY

Spotlight: CPI - BLS vs Truflation 🔦

The January CPI report was released on 02/13 and showed inflation at 2.4% YoY. Markets reacted quickly. Treasury yields moved lower and mortgage rates followed. Rate cut expectations for June increased after the release. At the same time, Truflation, an alternative metric for inflation, is currently reporting inflation at 0.94%, far below the official BLS (Bureau of Labor Statistics) CPI number. The gap comes from how each source collects and weights data, especially housing. I pay close attention to Truflation because it uses real-time pricing and tends to lead official CPI by about 45 days. For agents, sellers, buyers, and investors, that lead time can matter when forecasting rate moves and market momentum.

Highlights

• CPI ⬆️ 2.4% YoY

• Truflation current reading 0.94%, well below the Fed’s target of 2%

• BLS collects about 80,000 price quotes monthly through surveys

• Truflation aggregates 15M+ daily price points from 30+ sources

• A large share of CPI relies on modeled or estimated inputs rather than direct transactions

The largest driver of the difference between the CPI from the BLS and Truflation is housing. The BLS relies heavily on “Owners’ Equivalent Rent”, which asks homeowners what they think their home would rent for. That figure is estimated and often lags real rent trends by 6 to 12 months. The BLS also makes quality adjustments and fills gaps with statistical modeling. This leads to ESTIMATED inputs making up a substantial portion of the CPI index, often cited in the 30%-40% range.

Truflation, on the other hand, pulls live rental and retail pricing data and updates continuously. It reacts faster when inflation cools and when it reaccelerates. That makes it more responsive to turning points.

Takeaway: If inflation is actually running closer to 1% rather than ~2.5%, and price pressures are under better control than the BLS suggests, that is a clear signal in my opinion that rate cuts should be on the table sooner rather than later.

Macro Update 📊

Nationally, existing home sales remain weak, but locally the story is different. Central Ohio active inventory has declined six straight weeks, down 10.5% from recent highs, while showings are rising. Supply is tightening at the same time rates are easing, which could set up more competition if this trend continues.

Tailwinds

• Cooler than expected CPI data

• 10-Year Treasury ⬇️ 17 bps WoW

• Mortgage rates ⬇️ 12 bps WoW

• Central OH inventory ⬇️ 10.5% over 6 weeks

• Central OH showings per listing ⬆️ 11.9% WoW

Headwinds

• Purchase apps ⬇️ 2.4% WoW

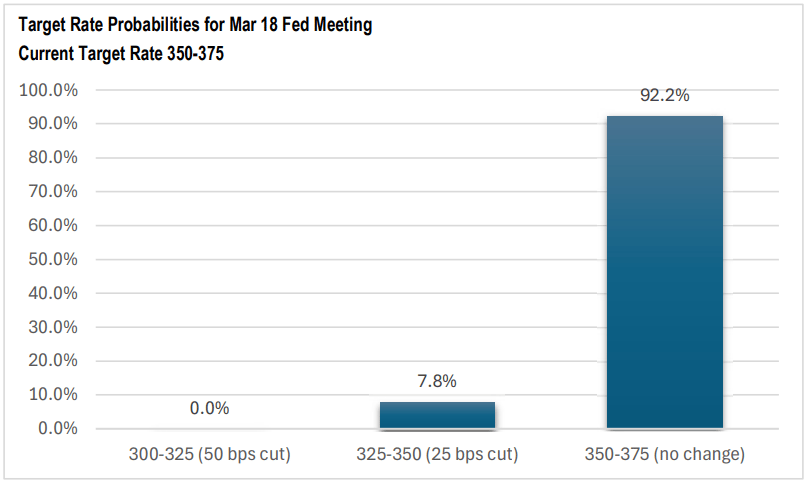

• Fed 92.2% probability of no change at next meeting

• Central OH - Over 52.1% of active listings have reduced price

30-Yr Mortgage Rates (Mortgage News Daily)

Mortgage Applications

Federal Reserve (CME FedWatch)

Truflation Index

The Truflation CPI Index uses real-time consumer spending data to track inflation daily. It updates faster than traditional inflation measures to better reflect price changes in today’s economy.

Central Ohio Market Update 🌎📍

Market Dynamics: A Seller’s Market shifting toward Buyer-friendly conditions.

Active inventory has now declined six straight weeks from 3,864 to 3,459, a 10.5% pullback. That drop is happening while showings rise week over week. Demand is not back to last year’s pace, but it is improving as rates ease. Inventory remains higher than last year, which still gives buyers an edge. If supply continues to shrink into spring, pricing pressure could firm up faster than many expect.

CURRENT ACTIVE INVENTORY: 3,459 homes ⬆️ 32.2% over LY and ⬇️ 4.0% WoW

Last 4 Weeks (01/19 - 02/15)

• CLOSINGS: 2,849 ⬆️ 0.4% over LY

• NEW LISTINGS: 3,278 ⬆️ 8.5% over LY

• MEDIAN sales price: $325,000 ⬆️ 3.2% over LY

• ⬇️ 52.1% of active listings have reduced price

• AVG DOM: 47 ⬆️ 17.5% over LY

Year-to-Date Snapshot

• YTD CLOSINGS: 2,218 ⬇️ 3.3% over LY

• YTD MEDIAN sales price: $325,000 ⬆️ 5.9% over LY

• YTD AVG $/SF: $206.68 ⬆️ 2.7% over LY

• YTD LP/SP%: 98.1% ⬆️ 0.8% over LY

• YTD NEW LISTINGS: 3,148 ⬆️ 12.8% over LY

Showings & Affordability

An affordability index of 100 means the median household can afford the mortgage on a median-priced home. Above 100 indicates greater affordability, below 100 indicates reduced affordability.

Local Events 🌎📍

Souces:

· 30-Year Fixed Rate Mortgage Average in the United States (MORTGAGE30US) - Federal Reserve Economic Data (FRED) - https://fred.stlouisfed.org/series/MORTGAGE30US

· 30-Year Fixed Mortgage Rates - Mortgage News Daily - https://www.mortgagenewsdaily.com/mortgage-rates/30-year-fixed

· Mortgage Applications, Purchase Index - Mortgage Bankers Association via Trading Economics - https://tradingeconomics.com/united-states/mba-purchase-index

· CME FedWatch Tool - CME Group - https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

· U.S. Inflation Rate - Truflation - https://truflation.com/marketplace/us-inflation-rate

Disclaimer: The information shared in this newsletter is for educational and informational purposes only and should not be considered legal, financial, or investment advice. Always consult with a qualified attorney, financial advisor, or other professional regarding your specific situation.

—

All data pulled from Columbus REALTORS® Multiple Listing Service (MLS). Central OH is defined as Single-Family, Residential listings from the following Counties - Franklin, Delaware, Licking, Fairfield, Union, Pickaway, Madison, Morrow, Fayette, Athens, Champaign, Clark, Clinton, Hocking, Knox, Logan, Marion, Muskingum, Perry, Ross. Sales figures do not account for seller concessions/credits provided to buyers. Price reductions are defined as a reduction taken at any time during the lifespan of the listing.